Electronic charges or remittances from suppliers and others. The Securities and Exchange Commission today charged Jose Luis Casero Sanchez a Spanish national and former Senior Compliance Analyst who worked in the Warsaw Poland office of an international investment bank with insider trading in advance of at least.

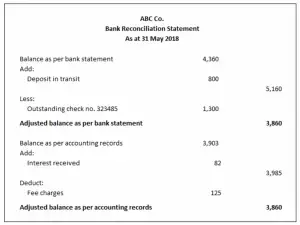

Adjustment In Bank Reconciliation Accountinguide

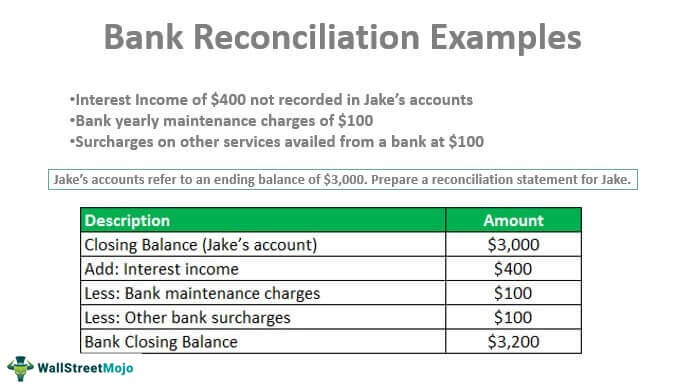

Bank Reconciliation Examples Top 6 Examples With Explanation

Bank Reconciliation

Any deferral rescheduling of facility granted to me by you shall be governed by Circular Letter No.

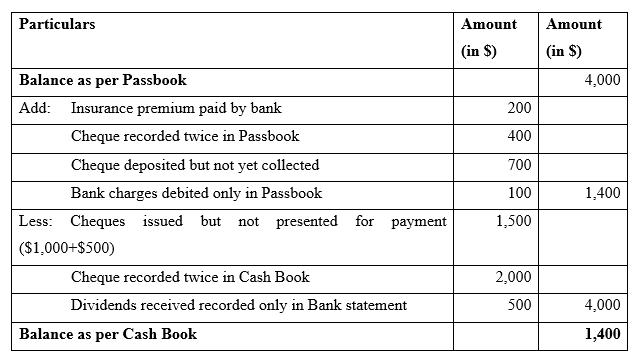

Bank charges in accounting. Saves time on manual data entry and helps to avoid mistakes. Discrepancies can be due to following reasons. Cheques issued by us but not yet presented in the bank.

A bank reconciliation statement is a document that compares the cash balance on a companys balance sheet Balance Sheet The balance sheet is one of the three fundamental financial statements. A check of 100 deposited by the company has been charged back as NSF. Makes it easier to get ready for tax time.

What is a Bank Reconciliation. In a Complaint filed in the US. Further it helps you to manage both incoming and outgoing payments for effective cash-balance management.

Electronic payments in or out Electronic payments in or out Includes online automated and debit card payments. An amount of 25 has been deducted by bank as service charges for the month of January. Examples of Journal Entries in a Bank Reconciliation.

District Court for the Western District of Tennessee the DOJ and CFPB alleged that from 2014 to 2018 the bank engaged in a pattern of redlining that included avoiding providing home loans and. A certificate of deposit CD is an interest-bearing deposit that can be withdrawn from a bank at will demand CD or at a fixed maturity date time CD. Deposits in transit are those deposits that are not reflected in the bank statement on the reconciliation date due to time lag between when a company deposits cash or cheque in its account and when the bank credits it.

Bank service charges include regular monthly fees overdraft fees returned check fees and credit card processing fees. Cheques of customers deposited but not credited by the bank. Reasons for Difference Between Bank Statement and Accounting Records.

There should be no discrepancy between your balance sheet and your bank statement. Details of Lloyds Bank Business rates and charges. Reconciling the two accounts helps.

Typically the company does not record these fees until the bank statement is received. Lloyds Bank plc and Lloyds Bank Corporate Markets plc are separate legal entities within the Lloyds Banking Group. If on the other hand you use cash basis accounting then you record every transaction at the same time the bank does.

To do this businesses need to take into account the bank charges NSF checks and errors in accounting. However in case of any late payment charges IWe shall be liable to pay before final settlement and closure of the relationship. Both are compatible with the Business Toolkit.

Amounts in checking and savings accounts. Bank service charge for maintaining the checking account. And an accounting and finance professor who has been working in the accounting and finance industries for more than.

A subtraction for a customers check that did not clear the customers. Once you link to another web site not maintained by First Neighbor Bank you are subject to the terms and conditions of that web site including but not limited to its privacy policy. In accounting cash includes coins.

Just like banks you too can make mistake in accounting the bank transactions in books of accounts and so. Monthly fee Monthly fee A fixed fee for operating your account 700. 25 Gresham Street London EC2V 7HN.

Reason being it is not known till you reconcile. And demand certificates of deposit. The bank statement contains a 200 check printing charge for new checks that the company ordered.

Bank Service Charges These are amounts that the bank withdraws from the account as a charge for having the account. They must be deducted from your cash account. Cheque issued or received is not presented to the bank for clearing.

14 of 2020 dated March 26 2020 of the State Bank of Pakistan. Lloyds Bank is a trading name of Lloyds Bank plc Bank of Scotland plc and Lloyds Bank Corporate Markets plc. Registered in England and Wales no2065.

Since the company records the increase in bank balance in its accounting records as soon as the cash or cheque is deposited the balance as per bank statement would be lower. Banks can also do mistake in debiting or crediting the transactions. First Neighbor Bank is not responsible for the products services andor any content presented on third party websites.

Provides better visibility and control of your finances. Bank interests charges etc. Undeposited negotiable instruments such as checks bank drafts and money orders.

The bank statement contains a 150 service charge for operating the bank account. Want to do your books on the big screen For the time being the Business Toolkit is available in online banking only. The bank statement shows that interest amounting to 50 has been earned on average account balance during January.

Are not accounted for. Interest from Bank is not recorded in Bank Book. The bank has charged 10 for the collection of a note.

The financial statements are key to both financial modeling and accounting. You only need to reconcile bank statements if you use the accrual method of accounting. To the corresponding amount on its bank statement.

Reconciling a bank statement is an important step to ensuring the accuracy of your financial data. The indictment marks the first charges against Makras who last year stepped down from the board of the Port Commission and the second for Kelly who was first charged a. A national bank settled CFPB DOJ and OCC allegations of redlining under the Fair Housing Act the Equal Credit Opportunity Act and the Consumer Financial Protection Act.

To reconcile bank statements carefully match transactions on the bank statement to the transactions in your accounting records. 17 October 2012 The commission paid on BG BAnk Guarantee shall be debited to Bank charges Guarantee commission Depending upon the materiality When bank guarantee is invoked the concerned banker pays the amount to your creditor and the amount should appear as loan in your books. Bank fees or service charges for maintaining the account fees for returned checks processing wire transfers check printing etc.

The bank statement rejects a deposit of 500 due to not sufficient funds and charges the company a 10 fee associated with the rejection. A bank statement is a record. Bank charges are service charges and fees deducted for the banks processing of the business checking account activity.

This is to confirm that all uncleared bank transactions you recorded actually went through. Good news for those of you on the Cash Accounting Scheme or the Flat Rate Scheme cash basis. A bank feed also known as a data feed links your business transaction accounts with your business accounting software and can help.

Some examples of bank debit memos include. This can include monthly charges or charges from overdrawing your account. Bank Accounting in SAP is a sub-application within SAP Financial Accounting FICO or S4HANA FinanceIt deals with managing accounting transactions with your banks.

A bank debit memo is an item on a companys bank account statement that reduces the companys checking account balance. Examples of Bank Debit Memo in a Bank Reconciliation. Common adjustments to the balance per books include.

Cash Payments in or out Cash Payments in or out Cash you pay into or withdraw from your account using our branch counter or deposit machine. Bank Charges may vary and are not recorded in Bank Book.

Payment Entry How To Record Included Bank Fees Accounting Erpnext Forum

Expectation Of The Job Becoming An Accountant

Bank Reconciliation Example Best 4 Example Of Bank Reconciliation

Bank Charges And Interest Abss Support

Chapter Seven Bank Accounts And Cash Funds Performance

Handling Of Bank Charges In Bank Statement Sap Blogs

Bank Reconciliation

/MacysbalanceSheetNov32018-146bc581861a44528f5802bbde519227.jpg)

Floating Charge Definition