Two years earlier the Group of 30 had recommended and one month earlier the Basel Committee had also recommended that institutions apply some form of backtesting to. For example Canada Savings Bonds CSBs have very low risk because they are issued by the government of Canada.

Risk And Return On Investitions Stock Illustration Illustration Of Investitions Relationship 166786167

A Fine Balancing Act Between Risk And Return On Investments

Financial Education Risk Return Youtube

Risk-free rate is the minimum rate of return that is expected on investment with zero risks by the investor which in general is the government bonds of well-developed countries.

Risk and return. Click here to know more. 143 Backtesting With Coverage Tests. They link analysis of our risk tolerance profile database to 40 plus years of month-by-month back-testing of historical portfolio performance.

Note however that increasingly return on risk-adjusted capital RORAC is used as a. A risk averse investor is an investor who prefers lower returns with known risks rather than higher returns with unknown risks. Investors take a risk when they expect to be rewarded for taking it.

Essay on impact of covid 19 in human life. The firm must compare the expected return from a given investment with the risk associated with it. Risk along with the return is a major consideration in capital budgeting decisions.

A risk-adjusted return is a calculation of the profit or potential profit from an investment that takes into account the degree of risk that must be accepted in order to achieve it. It is the hypothetical rate of return in practice it does not exist because every investment has a certain. Business risk is the possibilities a company will have lower than anticipated profits or experience a loss rather than taking a profit.

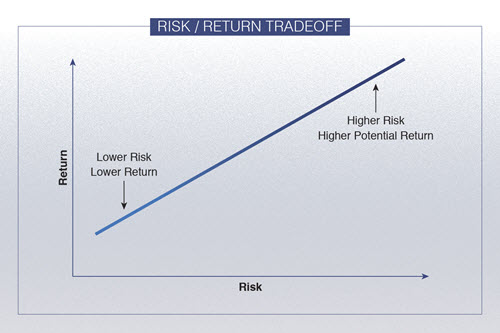

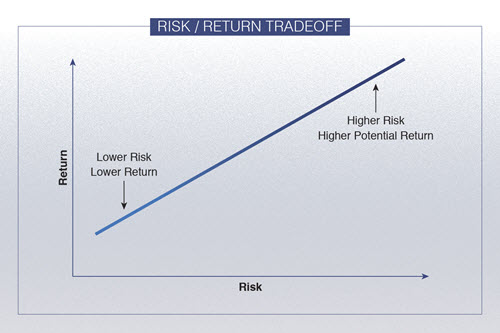

The tradeoff between Risk and Return is the principles theme in the investment decisions. The expected market risk premium is the difference between the expected return on the market and the risk-free rate. High Return Low Risk Retiree Investments.

Our Risk and Return reports provide clients with plain-English details of their risk and return expectations based on their answers to the risk tolerance profile. Cybersecurity risk is the probability of exposure or loss resulting from a cyber attack or data breach on your organization. Conventional wisdom in investing says theres a trade-off between risk and return.

There are multiple options to calibrate a risk adjustment model in light of differing metal levels Total expenditure. A better more encompassing definition is the potential loss or harm related to technical infrastructure use of technology or reputation of an organization. Quotes to conclude an essay.

Increased potential returns on investment usually go hand-in-hand with increased risk. Expenditures for low and high risk individuals will be farther apart in a bronze plan than in a platinum plan. Celtic wont risk Jullien in forced return Ange confirms By Paul Gillespie 21 November 2021 No Comments Ange Postecoglou has come out and stated categorically that he wont rush long-term injury casualty Christopher Jullien back from rehab because of people being anxious.

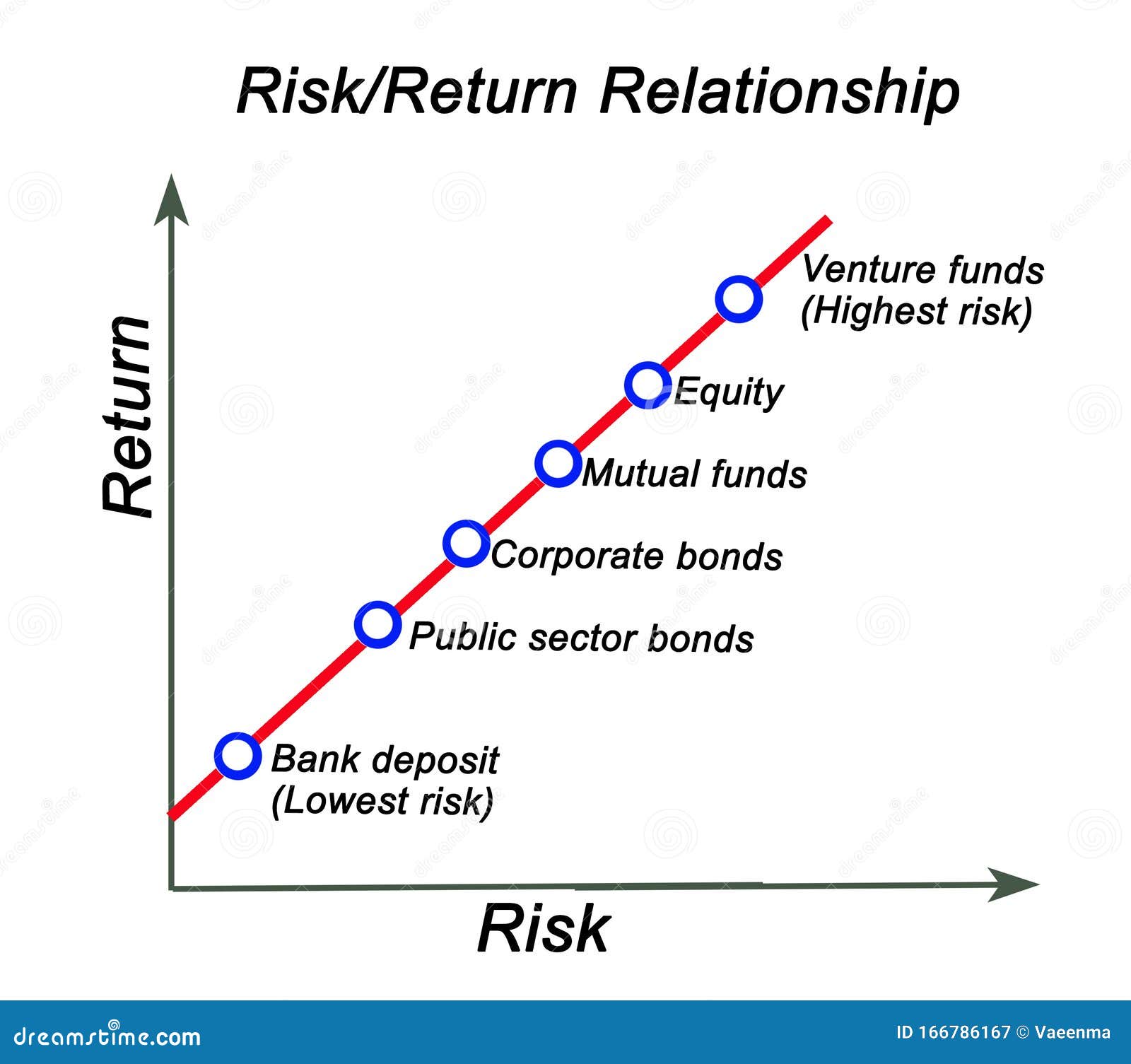

Higher risk is associated with greater probability of higher return and lower risk with a greater probability of smaller return. People invest because they hope to get a return from their investment. Since the markets beta is 1 and the risk-free rate has a beta of zero the slope of the Security Market Line equals the expected market risk premium.

Barefoot pilgrim is a slang term for an unsophisticated investor who loses all of his or her wealth by trading equities in the stock market. No mutual fund can guarantee its returns and no mutual fund is risk-free. Essay on impact of covid 19 in human life.

Risk-adjusted return on capital RAROC is a risk-based profitability measurement framework for analysing risk-adjusted financial performance and providing a consistent view of profitability across businesses. Risk refers to the variability of possible returns associated with a given investment. Interest rate risk is the risk that interest rates or the implied volatility will change.

Risk and return essay. QYLD and XYLD Theta Thwacking Strategies outperform QQQ and SPY Buy and Hold. Some investments are riskier than others theres a greater chance you could lose some or all of your money.

If an asset shows a lower risk than the overall market any return on the asset above the risk-free rate will be considered a gain. A barefoot pilgrim is someone who has taken on more. Risk and facility managers should always remember to take necessary actions before during and after an impairment to greatly reduce the risk of a fire breaking out.

The concept was developed by Bankers Trust and principal designer Dan Borge in the late 1970s. In other words among various investments giving the same return with different level of risks this investor always prefers the alternative with least interest. The risk adjustment weight is total expenditure and resulting risk score is.

Risk and return essay. Risk-adjusted return measures how much risk is associated with producing a certain return. The concept is used to measure the returns of different investments with different levels of risk against a benchmark.

In investing risk and return are highly correlated. Nature of Business Risk. The greater the potential return the greater the risk.

96 42 Risk and return essay. Advanced higher french discursive essay. This trade off which an investor faces between risk and return while considering investment decisions is called the risk return trade off.

Business risk is influenced by numerous factors including sales volume per-unit price input costs competition and the overall economic climate and government regulations. A risk averse investor avoids. Morgans RiskMetrics Technical Document described a graphical backtest the concept of backtesting was familiar at least within institutions then using value-at-risk.

Risk and Return Considerations. The risk of investing in mutual funds is determined by the underlying risks of the stocks bonds and other investments held by the fund. To make a lot of money you must take the chance of big losses.

The Chinese symbols for risk reproduced below give a much better description of risk the first symbol is the symbol for danger while the second is the symbol. Different types of risks include project-specific risk industry-specific risk competitive risk international risk and market risk. What is the Risk-Free Rate of Return.

A significant portion of high risk high return investments come from emerging markets that are perceived as volatile. Which are either US treasury bonds or German government bonds. Hypothetically an investor will be compensated for bearing more risk and thus will have more incentive to invest in riskier stock.

Understanding risk and return. Stocks that pay dividends can offer relative stability in the often-tumultuous world of equities.

Risk Return Tradeoffralphwakerly Com

Risk Return Tradeoff Definition

:max_bytes(150000):strip_icc()/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)

Risk Definition

Stocks Understanding The Risk Return Relationship

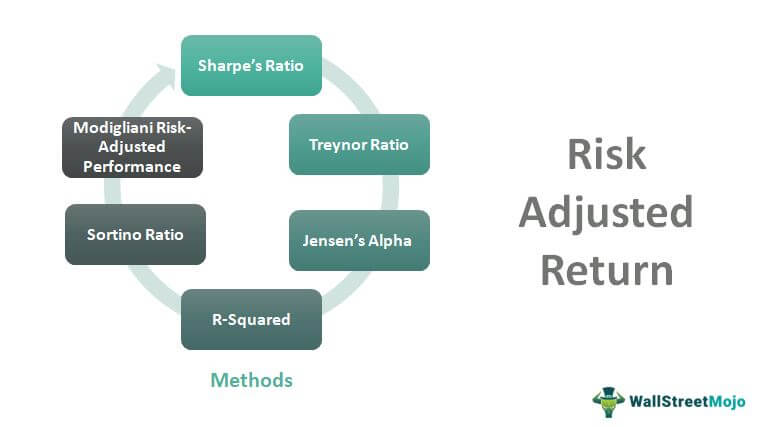

Risk Adjusted Return Top 6 Risk Ratios You Must Know

Risk Return Tradeoff Concept Investments Measurement More

Risk And Return How To Analyze Risks And Returns In Investing

Evaluating Risk And Return In Private Equity